Filament’s Shinobi Testnet is Live on inEVM 🥷

We are excited to unveil Filament to the world on Injective EVM.

Filament is the first MultiVM Perp DEX powered by Injective and brings together the best of Ethereum, Solana, and Cosmos built on inEVM, an EVM-compatible rollup on Injective in collaboration with Caldera.

Filament follows a hybrid design combining the orderbook with a novel liquidity pool (COMB Pool). Filament solves three key challenges:

- Funding rate stabilization in emerging DeFi ecosystems

- Trade inefficiency due to low liquidity

- Capital-efficient liquidity utilization to provide sustainable yet attractive yields for LPs

Built by power DeFi users and traders, Filament tackles the core challenges with existing Perp DEXs.

Why are we building on inEVM?

inEVM enables building applications that can uniquely leverage Injective’s blazing-fast speeds and near-zero fees while simultaneously achieving composability across the WASM and EVM world. In turn, this allows Injective to be the only L1 blockchain capable of unifying the interoperability of Cosmos with the speed of Solana and the developer access of Ethereum.

inEVM was built in collaboration with some of the foremost infrastructure projects in Web3 today, including rollup provider Caldera. In addition, prominent messaging layers such as Hyperlane and LayerZero have integrated with inEVM, allowing for the seamless transfer of data and assets. Celestia is set to serve as the Data Availability (DA) layer for the rollup, and Pyth as the oracle provider.

More on our Injective Thesis: https://x.com/FilamentFinance/status/1757046012676542967

Shinobi Testnet: Premiere for Filament’s Vision for On-chain Perps Trading

The Shinobi testnet celebrates the Injective Ecosystem's vibrant ninja community - the first home of Filament. It's designed for everyone from beginners to pro traders, marking a journey of growth and innovation similar to the training stages of a ninja.

https://x.com/FilamentFinance/status/1759559725749080372 (Embed)

Core Objectives:

Innovation Testing Ground: Shinobi serves as the crucible for Filament's novel ideas, like the COMB Pool model, fee socialization, and order parameters.

Community and Culture: By introducing trading guilds, Shinobi strengthens collective identity and embeds user communities into the protocol, offering advantages and fostering growth through targeted incentives. Currently, more than fourteen guilds are participating in the Shinobi testnet. Read more on guilds here.

Functionality Exploration: The testnet explores functionalities like strategy vaults on top of trading guilds and emphasizes a social layer for market making and asset listings, pushing the boundaries beyond typical DEX offerings.

Real-World Experimentation: Shinobi is set to test these functionalities with the community's active participation, ensuring that innovations are viable and impactful.

Integration and User Experience: Partnering with infrastructures like Hyperlane, the testnet focuses on seamless onboarding from EVM chains and utilizing Filament's LP tokens in broader applications, aiming for a user experience close to centralized exchanges while leveraging on-chain advantages.

The rollout of the Shinobi testnet is structured into two distinct phases, each designed to facilitate different stages of development, testing, and community engagement.

Phase One: Safelisted Testnet

The initial phase is a closed or safelisted testnet, where access is granted exclusively to users who have successfully minted their slots or been safelisted based on various criteria, such as community affiliation, staking involvement, or waitlist registration. This approach allows for a controlled and targeted testing environment, enabling the team to incrementally add more slots, introduce new guilds, and closely monitor user behavior and interaction with the platform. The primary focus of this phase is to refine the product, gather insightful data on asset trading and user engagement, and incentivize early adopters while minimizing the potential gaming of the system in an incentivized testnet setting.

Phase Two: Open Testnet

The second phase marks a transition to a more open environment, significantly increasing user caps or lifting restrictions to welcome a broader audience. This phase is characterized by the introduction of various integrations, expanding beyond the core product functionalities to include collaborations with other projects. Phase Two aims to stress-test the platform with a larger user base and explore interoperability with other systems, enhancing the overall ecosystem.

Rollout Process:

The rollout of the Shinobi testnet, commencing on March 15th, unfolds over three to four days through a structured process:

Minting Process: This initial step provides an equitable opportunity for early adopters to mint their slots, ensuring a fair chance for all interested participants to engage from the outset.

Bootstrapping Liquidity(March 16th): Users who have acquired slots can then contribute to the liquidity pool, effectively bootstrapping the protocol's liquidity. This step is crucial for testing the stable functioning of the COMB Pool.

Enabling Trading(March 18th): Safelisted users are then allowed to commence trading on the order book, signaling the start of live operations. This phase is pivotal for observing the interaction between initial capital, liquidity pools, and the order book, highlighting the cohesive functioning of all product components.

How to Dive into Filament on inEVM

Firstly, check if your wallet is safelisted on the Guilds page. The testnet is only accessible to safelisted wallets.

1. Connect to Testnet

Head over to testnet.filament.finance

Click on “Connect” on the top-right corner

Select “Metamask” from the popup(more wallets will be supported soon)

You will get a prompt to “Switch network to Injective” (switching to Injective EVM)

Approve chain switching on your Metamask wallet

Note: To connect to testnet, use the EVM wallet you provided during safelisting process, not the one you used to check eligibility(Keplr, Backpack, etc) i.e. the ERC-20 wallet address you provided while safelisting on the page below.

You can also add the Injective EVM network manually to your wallet using the following details:

Network name - inevm-testnet

Network URL - https://testnet.rpc.inevm.com/http

Chain ID - 2424

Currency symbol - INJNote: You might get a warning on your Metamask wallet stating “This token symbol doesn't match the network name or chain ID entered”, please go ahead and ignore these warnings.

Once you have switched the network, head over to the faucet page to begin minting.

2. Faucet Minting

If you’re safelisted, the first step is to start with minting testnet USD - USDFilament.

Key things about faucet minting:

Filament has a built-in faucet

Users will be able to mint a 1000 USDFilament per week

Follow the steps below to mint USDFilament from the faucet

Head over to the faucet page. You will automatically land on the faucet page once you connect your wallet to Filament and switch to Injective EVM. Click on “Mint Faucet” on the page.

Once minted, you will see the below screen. To see the tokens in your wallet you will need to add the token to your wallet, Copy the token address(given on the page), and add it to your wallet.

Follow the steps below to add the token to your wallet:

Step 1 - Click on “Import tokens” on your wallet

Step 2 - Paste the token address mentioned on the faucet page, and click “Next”.

Step 3 - Click “Import” on the next screen to add the token to your wallet.

You may also enter token details on your wallet manually

Address: 0xC540a9FbeBfA1cbAE5618558A8937c674c42322c

Symbol: USDFilament

Token Decimal: 6Follow the video below for a walkthrough of connecting to the testnet and minting USDFilament:

Using INJ Faucet

You will also need testnet $INJ to pay for gas fees on transactions.

Once you have connected your wallet, click on “Get INJ Faucet” on the top right corner on the app.

Switch to the faucet tab on the page, enter your wallet address, and click “Request”.

3. Liquidity Provision

The second part of the testnet rollout would enable the liquidity pools on Filament. Follow the steps below to provide liquidity to the COMB(Compartment-based) pool and support trading on the Filament.

Step 1 - Head over to the pool page, enter the amount of USDFilament you want to add to the pool, and click on “Deposit”.

Step 2 - You will get a prompt on your wallet to sign the transaction to enable Filament to access the fund in your wallet. Another prompt would request you to approve the transaction to deposit liquidity.

Step 3 - You will get a confirmation on the popup once the liquidity is added to the pool.

You will be able to see your liquidity position on the pool page. Users will also be able to stake their liquidity(for 7 days) to earn additional rewards.

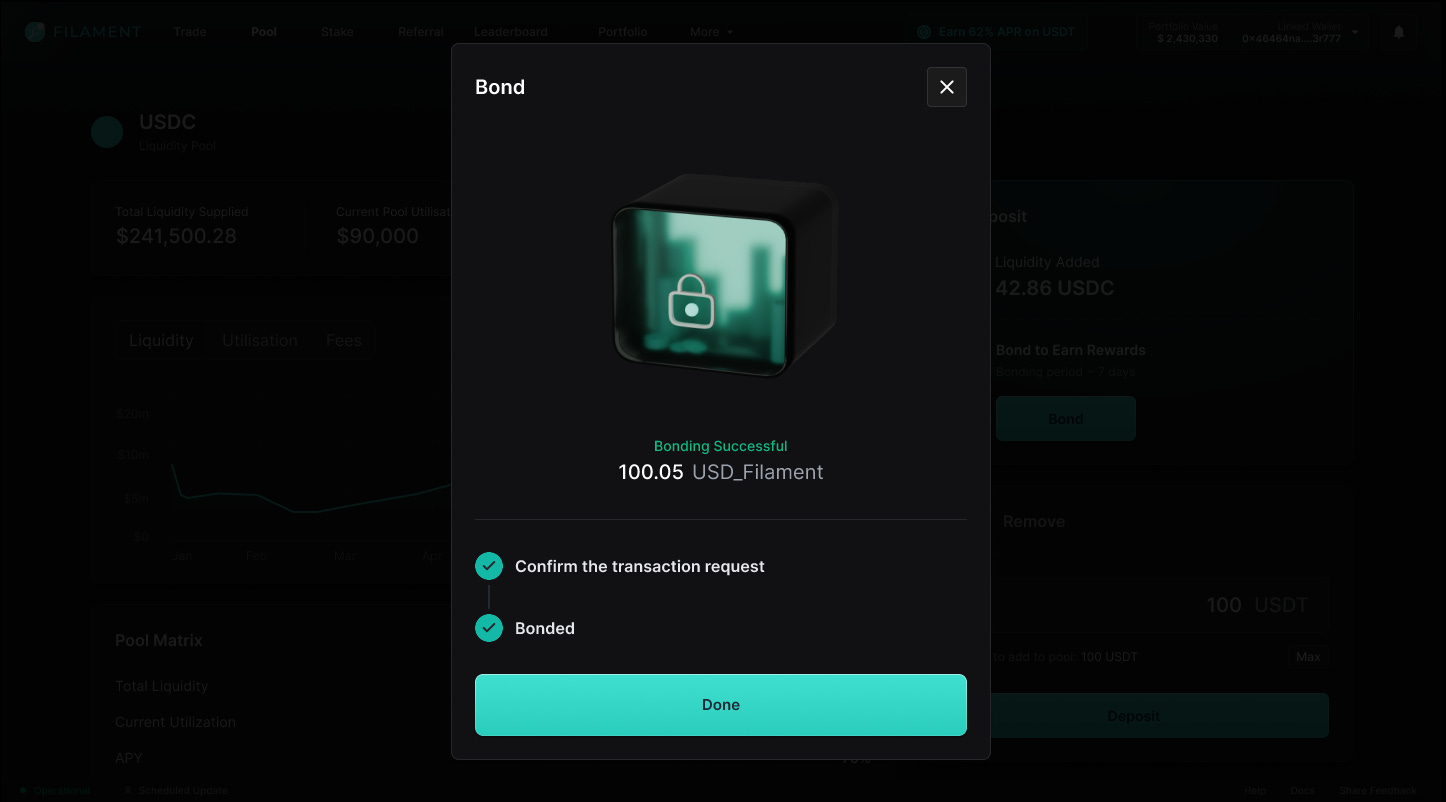

Follow the steps below to bond your liquidity:

Step 1 - Click on “Bond” on the pool page below to bond your liquidity.

Step 2 - You will get a popup, enter the amount of USDFilament to stake and click on “Bond”

Step 3 - Confirm the transaction on your wallet. You will be able to see a confirmation on the popup.

You can check your bonded position on the Bond page on the app.

4. Trading

The last part of the testnet rollout would enable trading on the platform.

Head over to the Trade page, enter the details like size, leverage, stop loss, etc. on the panel on the right side of the trade window, and go long or short.

You will see your open positions, order, history, P&L, and balance at the bottom of the screen on the left.

You can manage/update any of the positions by clicking on “Manage” beside the position on the list at the bottom.

Earn Real POINTS (not the mundane boring numbers on the frontend)

A total of 4.8 million POINTS will be distributed among users participating in various activities, from trading to outreach contributions and helping onboard new users. The Shinobi testnet introduces a unique approach to incentivization, aiming to enhance user engagement and product testing effectiveness through a dynamic point system. Unlike conventional DeFi applications where points can sometimes become monotonous and prone to exploitation, we seek to reinvent this model to maintain the interest and fairness of its ecosystem.

Product Incentivized Actions:

Users on the Shinobi testnet will be rewarded for a variety of actions integral to the platform's operations and development, including trading volume, profit and loss (PNL), liquidity provision, liquidity locking, and participation in referral programs. These incentives are not just about rewarding participation but are essential for stress-testing the platform's capabilities and stability.

Dynamic Point System:

To move beyond the limitations of traditional point systems, there’s a twist: POINTS can be used to leverage positions, mirroring the risks and rewards of real-world trading environments. This means users can choose to risk their POINTS for potentially higher rewards, but also face the possibility of losing them. This mechanism serves dual purposes—first, it simulates the real-world pressures and decisions traders face on leveraged platforms; second, it ensures that the points have intrinsic value and utility within the testnet, allowing for a more meaningful and engaging testing experience.

Community Incentivised Actions:

The Shinobi testnet recognizes and rewards a variety of community-driven contributions, including:

Creating Educational Content: Users producing tutorials, guides, or any form of educational material that aids in understanding the platform's functionalities.

Providing Feedback: Constructive feedback on the testnet's performance, features, and user experience.

Making Introductions for Integrations: Facilitating partnerships or integrations that could enhance the platform's capabilities and reach.

Onboarding New Users: Helping new participants navigate and get started with the testnet, fostering a welcoming environment.

Language Support: Assisting in translating documentation and resources to ensure accessibility for a global audience.

Content Creation: Generating engaging content such as memes and stickers that contribute to the community's vibrancy and cohesion.

Early Birds are Rewarded, But Those Who Stick Around are Rewarded More

At Filament, we focus on the importance of long-term engagement with the Shinobi testnet and opportunities are abound even for those who missed initial access:

Weekly Onboarding: New slots are regularly opened for different community members, including Injective stakers and active contributors. Keep an eye out for these opportunities.

Active Participation Channels: Stay updated and engaged through the Filament's Discord and Twitter. These platforms are key for news, updates, and joining instructions.

Community Engagement Rewards: Beyond direct product testing, contributing content, feedback, or support enhances the ecosystem, with rewards for these contributions as well.

Gradual Scaling Approach: The Shinobi testnet aims to scale thoughtfully, focusing on specific tests and improvements. This approach values and prioritizes the quality of engagement over mere early access.

Filament’s journey is just beginning, and we invite all to be a part of this transformative adventure. Whether you've secured early access or are looking to join in future phases, Shinobi testnet underscores a key message: staying engaged and contributing to the ecosystem brings rewards far beyond the early stages, highlighting the lasting value of growth, innovation, and community in the ever-evolving landscape of DeFi.

Don’t wait jump in now:

Discord: https://discord.gg/filament-finance

X (Previously Twitter): https://twitter.com/FilamentFinance

Farcaster (getting started here): https://warpcast.com/filament-finance