WTF are Perpetual Contracts?

Filament Learn For Growth (LFG) #1: A comprehensive overview of what are Perpetual Contracts and how Perpetual Contracts work.

In the wake of traditional futures, which changed the way commodities and stocks were traded by introducing time-bound contracts for future delivery at pre-agreed prices, cryptocurrency markets introduced perpetual futures. They became an important financial instrument designed to mimic the spot market with added leverage, but without the restrictions of settlement dates. This development was driven by the market's continuous nature, and traders' desire for ongoing, flexible trading opportunities which traditional financial markets could not offer.

Crypto Perpetual’s rise to prominence in trading volumes indicates their significance. Traders choose perpetual contracts over other instruments due to their adaptability to market conditions, ability to provide significant leverage, and the ease of executing complex trading strategies without time constraints. Platforms like Filament are emerging in this space, aiming to simplify the perpetual trading experience for users while offering innovative solutions for liquidity and risk management.

A Deep Dive into Perpetual Contracts

Financial derivatives are the lifeblood of sophisticated trading strategies, allowing nuanced positions on future price movements without requiring ownership of the underlying asset. Perpetual contracts have taken this a step further by removing expiration dates, enabling perpetual adjustment to the trader's exposure.

The Anatomy of a Perpetual Contract

Perpetual contracts operate similarly to spot markets but with the significant addition of leverage. They replicate the spot price via a funding rate—essentially a periodic fee that long positions pay to shorts, or vice versa, based on market leverage and position imbalances.

An Illustrative Scenario

Imagine a trader who takes a long perpetual contract position on Bitcoin at $20,000, using 10x leverage. The trader's $20,000 now controls a $200,000 position. If the price of Bitcoin climbs to $22,000, the position's value rises to $220,000. Subtracting the initial $200,000, the trader's profit is $20,000—a 100% return on their initial margin, excluding funding rates and fees. This demonstrates the power of leverage in amplifying returns.

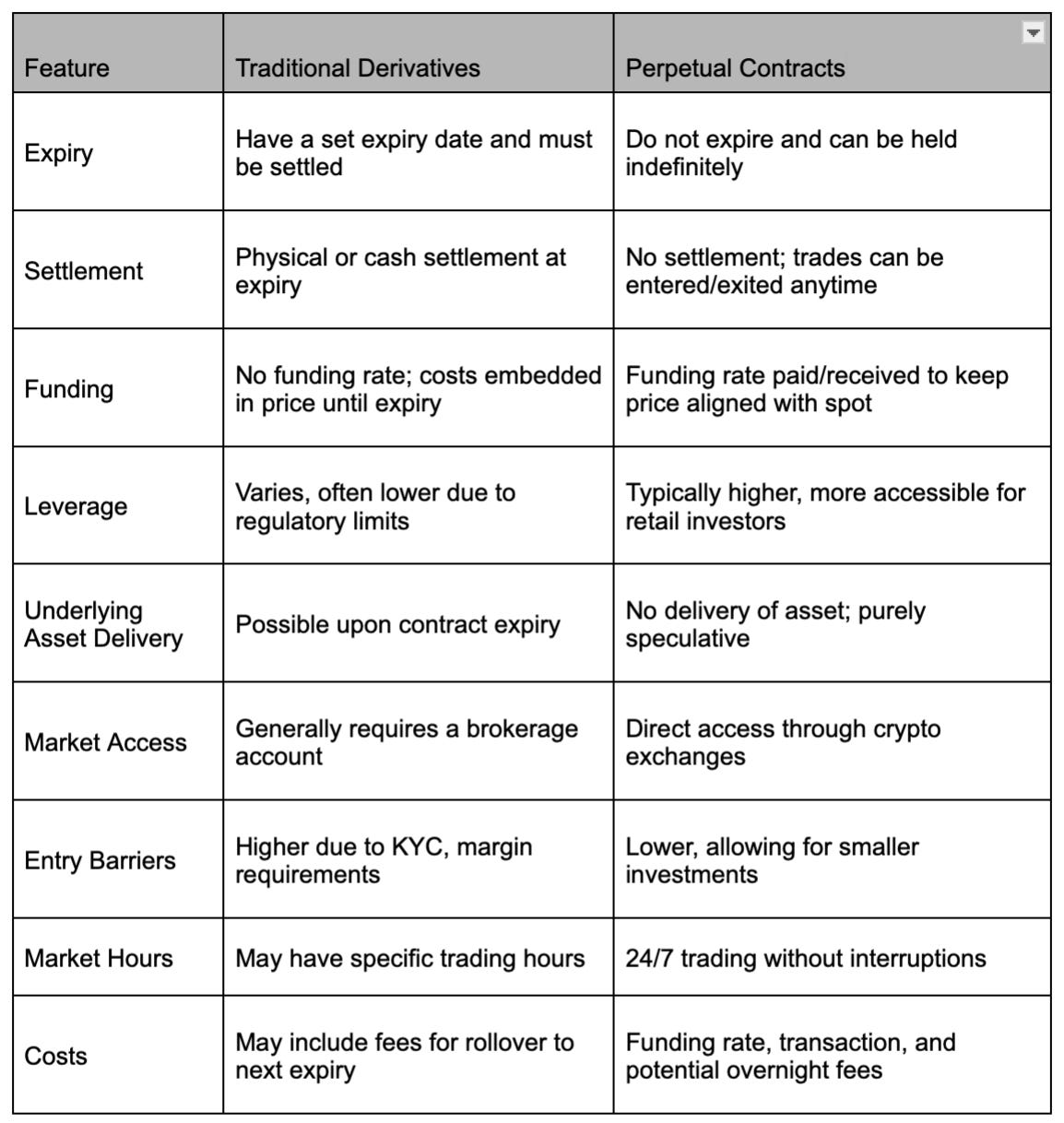

Here’s a tabular comparison between traditional derivatives (like futures contracts) and perpetual contracts:

Mechanics of Perpetual Contracts

Perpetual exchanges enable users to take long or short positions in perpetual contracts by depositing a minimum amount of collateral, referred to as the "initial margin." This margin is a specified percentage of the trade value that the trader is required to maintain to open a position.

To better comprehend how perpetual contracts function, one must understand their components:

Leverage: Leverage in perpetual contracts allows traders to amplify their exposure to price movements of cryptocurrencies without committing the full value of the position. For instance, with 10x leverage, a trader can enter a position worth ten times the value of their margin. This can significantly increase potential profits but also magnifies potential losses, making it crucial for traders to use leverage cautiously.

Funding Rate: The funding rate is a unique mechanism to perpetual contracts that helps to keep the perpetual contract price in line with the underlying spot price. It is a periodic payment that is exchanged between long and short positions. If the rate is positive, long position holders pay short position holders, which typically happens when the perpetual contract price is higher than the spot price. Conversely, a negative funding rate means short position holders pay long position holders, reflecting a perpetual contract price below the spot price. This rate adjusts based on market conditions and is an essential tool for managing the perpetual contract's price alignment with the spot market.

Margin Requirements: To open a leveraged position in a perpetual contract, traders must provide collateral, known as margin. There are two types of margins: initial margin, which is the amount required to open a position, and maintenance margin, which is the minimum amount that must be maintained in the trader's balance to keep the positions open. If the balance falls below the maintenance margin due to losses, the trader must add more funds or risk liquidation of their positions.

Liquidation Protocols: Liquidation occurs when a trader's position is closed by the exchange because the value of the position falls below the maintenance margin. This is a risk management feature that protects both the trader from incurring further losses and the exchange from the risk of the trader not being able to cover the loss. Perpetual contracts employ an automatic liquidation process where, if the price moves against the trader's position and the margin level is breached, the position is closed at the prevailing market price.

Price Alignment Mechanism: Besides the funding rate, perpetual contracts often use a Price Alignment Interest (PAI), which is another tool to ensure that the perpetual contract's price does not deviate significantly from the underlying spot price. The PAI is an interest that is paid or received for holding a position and is adjusted regularly based on the difference between the contract price and the spot price.

Mark Price: To prevent unfair liquidations during market manipulation or extreme volatility, perpetual contracts use a 'mark price' system. The mark price is a fair price indicator, often calculated based on a weighted index of spot prices from multiple exchanges. It is used to determine the unrealized profit and loss (PnL) and liquidation thresholds, rather than the last traded price.

Auto-Deleveraging (ADL): In some cases, the protocol liquidity may not be enough to cover the profits for the traders. In such cases, the Auto-Deleveraging system may kick in. This system ranks traders by profit and leverage, and the most profitable and highly leveraged positions may be deleveraged to cover the shortfall, ensuring the system's integrity.

Strategic Advantages of Perpetual Contracts

The benefits of perpetuals go beyond simple speculation. They offer the following strategic advantages:

Market Access: Perpetual contracts provide a streamlined path to enter cryptocurrency markets with leverage, enabling significant exposure with lower capital requirements.

No Expiry: Unlike options, there's no expiry factor with perpetuals, meaning the perpetual contract can be held as long as the position can be managed.

Hedging Efficiency: They are an excellent tool for hedging existing positions due to their ability to be held indefinitely and their relatively straightforward pricing as compared to options.

Filament's approach to perpetual contracts also includes features like delta neutral vaults, which aim to reduce the risk associated with exposure to volatile assets.

Market Scenario:

In May 2021, the cryptocurrency market experienced a significant correction, with Bitcoin's price dropping from around $59,000 to nearly $30,000 over a few weeks. Consider a trader named Alex, who is optimistic about Bitcoin's long-term price and decides to open a long perpetual contract position when Bitcoin is at $50,000. Alex uses 10x leverage with a $5,000 margin, effectively controlling a position worth $50,000.

However, as Bitcoin's price drops to $46,000, the position begins to near liquidation. The contract's value has decreased by $5,000, which is Alex's initial margin. Had the price moved against Alex's position by just $5,000 (10% of the controlled position), Alex would have been completely liquidated due to the leverage used.

But in this scenario, let's assume Alex has the foresight to provide additional collateral to the position to avoid being liquidated. If Alex can sustain the position through the downturn and the market subsequently recovers, there's potential for a profitable outcome. For instance, if Bitcoin's price rebounds to $55,000, the contract's value increases by $5,000, translating to a 100% return on Alex's original margin, excluding funding rate costs and any additional collateral provided to avoid liquidation.

Utilizing Perpetual Contracts in Advanced Trading Strategies

Experienced traders employ perpetual contracts in sophisticated ways, such as:

Directional Bets: Traders take a position on the anticipated price movement of a cryptocurrency over a certain period. They may go long if they expect the price to rise or short if they expect it to fall. The advantage of perpetual contracts is that traders can hold these positions for as long as they believe the trend will continue, without worrying about expiration dates.

Funding Rate Arbitrage: This strategy exploits the differences between the funding rates of perpetual contracts and the spot price of the underlying asset. If the funding rate is positive, it indicates that longs are paying shorts, and if it's negative, shorts pay longs. Traders can take positions in anticipation of these payments to earn a profit, often by holding an offsetting position in the spot market to hedge their exposure.

Hedging: Traders use perpetual contracts to hedge other positions in their portfolio. For example, if a trader holds a significant amount of a cryptocurrency and fears a short-term drop in price, they might open a short position in a perpetual contract to offset potential losses.

Navigating the Risks of Crypto Perpetuals

While the rewards can be enticing, the risks are equally pronounced:

Extreme Market Conditions: In volatile market periods, positions can be liquidated swiftly, especially when highly leveraged.

Funding Rate Fluctuations: Unpredictable funding rate changes can erode profits or exacerbate losses.

Counterparty Risks: Since perpetuals are typically traded on exchanges, the trader is exposed to the exchange's operational and financial integrity.

Filament's platform is designed to mitigate some of these risks by providing an insurance module for liquidity providers.

Risks Quantified:

Imagine a crypto trader, Dana, who anticipates a decrease in the price of Ethereum (ETH). ETH is trading at $2,000, and Dana decides to enter a short position on a perpetual contract with an initial margin of $10,000 at 20x leverage. This allows Dana to control a position worth $200,000 (20 x $10,000).

Shortly after Dana enters the position, instead of declining, the price of ETH begins to rise due to a surge in market optimism and increased buying pressure. If the price of ETH increases by just 5%, the position is now 5% worse off on a $200,000 position, which is a loss of $10,000—equivalent to Dana's entire initial margin.

Here's the critical part that illustrates the amplified risk due to leverage: because Dana is using 20x leverage, a 5% move against the position fully exhausts the margin, putting Dana at the brink of liquidation. In a fast-moving market, this can happen in a matter of minutes or even seconds.

Additionally, since perpetual contracts require funding payments to ensure the price stays anchored to the spot market, let's say the market is bullish, and the funding rate is positive, meaning shorts must pay longs. If the funding rate is 0.1% per eight hours (a standard duration for funding payments), Dana would owe an additional $200 every eight hours as long as the position is open and the funding rate stays the same.

If Dana fails to close the position or add more margin and the market continues to trend upwards, even slightly, Dana's position will be liquidated. In this case, the funding rate exacerbates losses, and the high leverage leaves very little room for error. This situation underscores the extreme risks associated with high leverage in perpetual contracts, particularly in a market that can move quickly and unpredictably.

Risk Management Strategies:

Setting Stop-Loss and Take-Profit: Experienced traders always set a stop-loss order at a price level that represents a tolerable loss, ensuring they does not incur more loss than necessary. They also sets take-profit orders to secure earnings when the market reaches a price that provides them with a satisfactory return.

Diversification: Experienced traders diversify their exposure by allocating their capital across several cryptocurrencies' perpetual contracts. For example, they hedge their long positions in altcoins with short positions in Bitcoin, balancing their portfolio against market moves.

Position Sizing: A risk-averse trader, uses the 2% rule, never risking more than 2% of their total trading capital on a single trade. By doing this, they ensures that even a series of losses won't significantly draw down her total capital.

Monitoring and Adjusting Leverage: A seasoned trader monitors their positions daily, adjusting the leverage based on market volatility. For example, after entering a position with 10x leverage, if the market moves favorably, they reduces leverage to lock in profits and minimize risk.

The risk management strategies employed by Filament, such as dynamic liquidity pools and insurance mechanisms, are examples of how perpetual contract platforms are evolving to offer more secure and efficient trading environments.

Conclusion

Perpetual contracts are a revolutionary tool in the crypto trading space, providing flexibility and leverage that can lead to significant profits but also entail considerable risk. A deep understanding of their workings, coupled with prudent risk management, is indispensable for traders who wish to navigate this landscape successfully. As this market matures, we may expect perpetual contracts to evolve further, possibly integrating more features from traditional finance and becoming even more ingrained in the fabric of cryptocurrency trading.